ABOUT OUR

LAW FIRM

Experience Sets Us Apart

At Shinners & Cook, we’ve built long-term relationships with hundreds of Saginaw, Michigan businessmen and women by providing expert legal counsel and outstanding professional service. As business people ourselves, we know how important it is to respect our clients’ priorities, time, and need for complete confidentiality.

Shinners & Cook provides a full range of legal services, representing clients with business, estate planning, litigation, and real estate needs. Our full-service approach allows us to build relationships with our clients that solo practitioners and large firms cannot offer. Our collaborative legal team provides each client with strong legal representation, and in a prompt, professional manner.

Areas of

Practice

We provide provide a full range of legal services, representing clients with business, estate planning, litigation, and real estate needs.

Business Law

The law’s impact on your business interests can be complex and must take…

Read More

Elder Law

The high cost of long-term care has made planning a critically important issue…

Read More

Easements

Understanding the different types of easements is very important so you…

Read More

Business Ligitation

The law’s impact on your business interests can be complex and must take…

Read More

Estate Planning

Protecting your hard-earned assets or your family business from IRS taxes…

Read More

Liquor License Transfers

Liquor license laws in Michigan can be somewhat confusing, but an…

Read More

Litigation / Conflict Resolution

Our goal at Shinners & Cook is to perform perform so well that our clients…

Read More

Real Estate

We understand that your business and personal transactions can be…

Read More

Probate & Trust Administration

There are some circumstances and occasions where probate either…

Read More

Our full-service approach allows us to build relationships with our clients that solo practitioners and large firms cannot offer. Our collaborative legal team provides each client with strong legal representation, and in a prompt, professional manner.

Testimonials

What Our ClientsHave to say

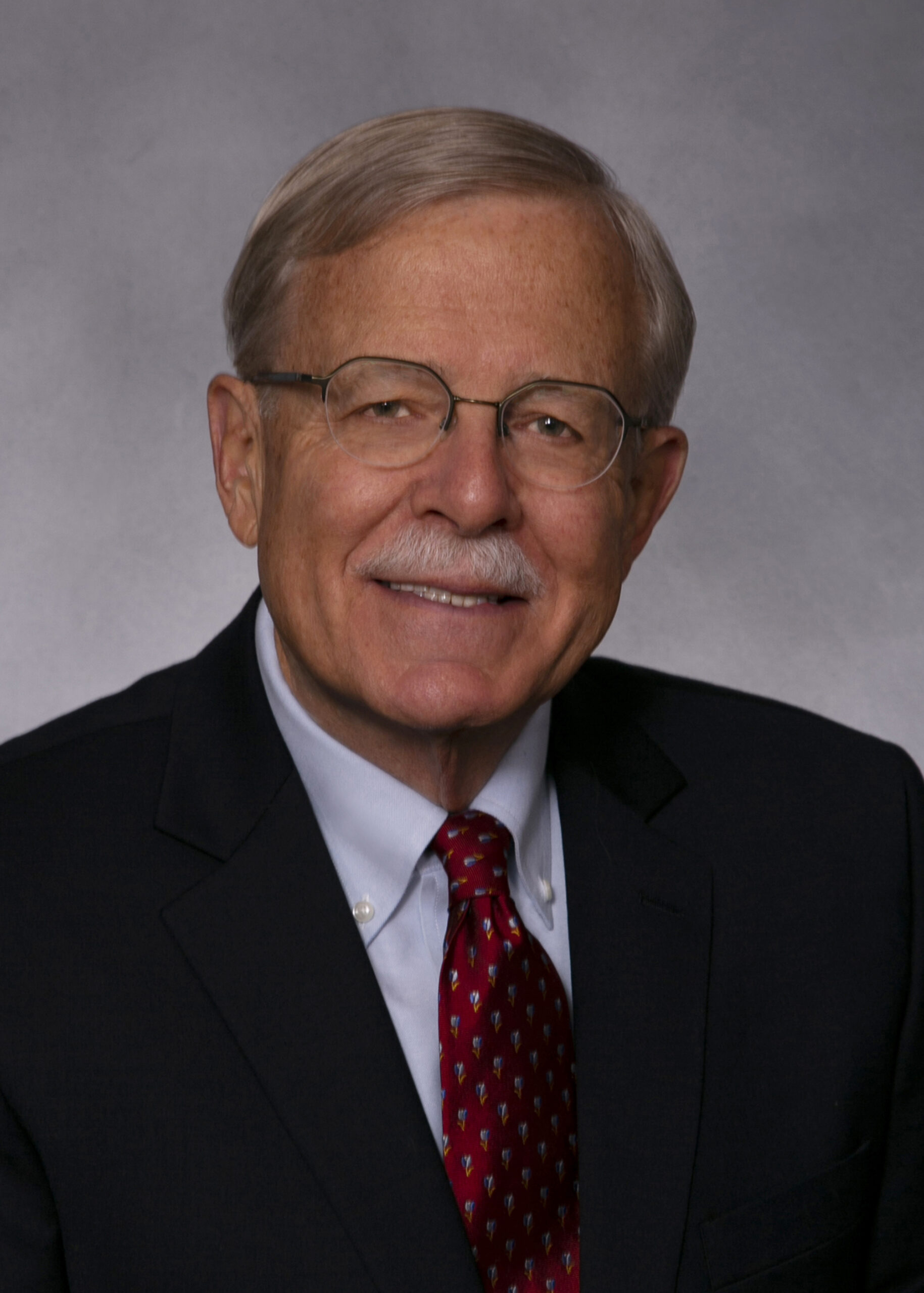

Our Team

Members

leadership